Angelina Yao is a former portfolio manager at BlackRock and the founder of Heels & Yield, which offers female-focused financial management consultancy services.

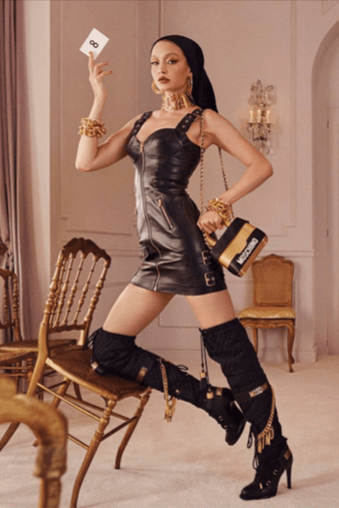

As an investment professional devoted to helping women achieve financial freedom, I often tell my clients that they already have an instinct for how to invest. I know, because they, like me, have an eye for fashion.

Investing is like putting together a wardrobe — you want plenty of classics that never go out of style, mixed with some daring statement pieces. But unlike being a fashionista, investing prizes a high level of patience, long-term thinking, and resisting your urges.

Here’s what I tell my clients about how to dip their toes in the stock market.

Decide how much money you’re willing to invest — and lose

You should look at the money you’re investing as paying for an experience, a lesson in personal development. Becoming good at it requires trial and error. Let’s say you have $1,000 that you might otherwise spend on shoes. Consider using $200 of that to invest.

Of course, you may decide to invest more money, or less. Many of my clients invest at least 10 percent of their salaries to reach various short- and long-term goals, on top of what they’re saving for retirement. If you just want to experiment, start with a smaller amount. Plan to stay invested at least five years, as that’s about how long it takes to see returns.

Bottom line, any money that you invest is money that you could potentially lose. But there are ways to lessen your risk of losing money, as I’ll explain further.

Determine your risk profile

Are you one to fret, and take it really hard when you lose a bit of money? Or do you court risk, knowing that with no pain, there’s no gain?

Some people are more sensitive to losing money than they are to making money. Some would prefer to make a guaranteed $2 for every $10 invested, while others find more pleasure in the possibility of making $9 for every $10 invested, even if it comes with risk.

There are various tools, including online, that will test your risk tolerance. For a professional risk tolerance tool, seek out an investment, financial planner or financial coach.

The basic idea is to be honest with yourself about your personality, and whether your life situation allows for uncertainty or demands stability.

Use a robo-advisor

Most investing beginners don’t have the time or expertise to study companies, read quarterly reports, and do the research in order to trade individual stocks.

That’s why I suggest robo-advisors, online platforms created by investment professionals that use algorithms to invest your money. With robo-advisors, you can pick themes that align with your values, so if you’re interested in fashion, or tech, or alternative energy, you can invest in those industries.

Robo-advisors typically offer low fees and aim to give you at least market-rate returns, so you can worry less about losing money or taking excessive risk. There are currently three robo-advisors in Hong Kong which are available to individual retail clients: Aqumon, Youyu Wealth and Kristal.ai.

Learn the difference between investing and speculating

You may have friends who struck gold by investing in bitcoin. Sounds like you should too, right? Bitcoin isn’t actually traded on traditional stock markets, but plenty of other volatile securities are. I mention bitcoin because it’s led to an explosion of interest in investing.

Other than cryptocurrencies, investing in new and exciting industries like biotechnology (“the latest cancer cure”) can be lucrative. If you’re extremely lucky, you might get the timing right by going in early, and the “cure” pans out because you’ve done your research into the drug approval process behind it very well.

But investing in experimental or highly exciting ideas and companies can be like betting on the price of obscure artworks or Beanie Babies — there may not be enough underlying value (at the moment) to what you’re investing in, and it’s so risky that you’re basically gambling.

Investing means doing your research and putting your money into time-tested companies that are poised to expand. Speculating is chasing whatever stock is “hot” right now, regardless of whether it has a solid infrastructure.

That said, if you have a passion for an alternative investment like cryptocurrency, feel free to dabble but know the risks.

This article is for general guidance and informational purposes only and should not be treated as legal, accounting, financial, investment or tax advice. For specific questions related to your financial, legal or tax situation, please consult a professional advisor.

Editor

Angelina YaoCredit

Header image: Horst P. Horst/Conde Nast via Getty Images