When I was at the height of my career at one of the world’s largest asset management firms, I thought I had it all. I was financially secure with a lovingly curated closet full of designer labels. But a serious injury forced me to take several months off, and during that time I realised I was spent. I’d accumulated “wealth” and could afford a spa vacation if I wanted it, but my life was woefully out of balance. My job demanded all my time – leaving my health, creativity and time for family and friends to suffer.

Similarly, no amount of meditation retreats or stress-shopping can fulfil you if your finances aren’t in order. Now, my work is to help women achieve what I call “holistic wealth” – financial fitness that works hand-in-hand with overall wellbeing. By living a life of balance, you’re more likely to meet your financial goals and enjoy your other pursuits in a way that’s sustainable.

Visualise your dream life

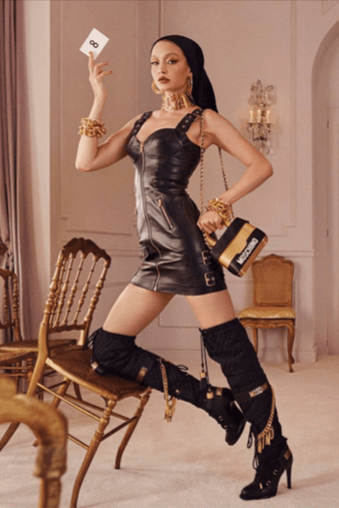

One of the first tools to begin establishing “holistic wealth” is to create a dream board in order to envision what financial freedom would look like to you. For some, financial wellness means stress-free time to care for family. For others, it’s the ability to pursue a long-held ambition, like starting a business or living abroad. Others want luxurious vacations and fabulous wardrobes. Some want all of the above.

Visualisation is a powerful tool, providing clues about your values, which in turn inform your goals. For example, you may have no time for hobbies, but your dream board might reveal that you long to spend time painting, or volunteering at an animal shelter. Those are activities you could start making time for now, and also weave into long-term plans for investing and charitable giving.

Know your numbers

Develop an understanding of every place that money comes into, and goes out of. That means knowing your exact income, expenses, savings, loans, retirement contributions, investments, and all your other financial scenarios.

Start by writing out each of your fixed monthly expenses and calculate out how much you realistically spend on items with variable amounts, like groceries, dining out, and clothing. You can do this on a spreadsheet or app. You’d be surprised how many people – even those who are really good with money – don’t know exactly how much they spend. Shame often gets in the way of diving into these details.

Another step is to figure out how you’ll achieve goals like owning a home, travelling, or starting a business. We offer financial calculators on our website that can help you ascertain how much money you’ll need to save each month and how long your goals will take.

By no means is this a comprehensive guide to getting your finances in order, but even small steps toward becoming more intimate with your budget are important.

Align your finances with your values

Too often we fail to stick with our financial goals because they are cold, calculated and divorced from the things we care about. Watching hundreds of dollars leave your pay check and go into a retirement fund that invests in corporations you know nothing about, or that rely on unethical business practices, may not be very motivating.

Instead, I encourage my clients to choose some of their investments in alignment with their values. Impact investing is a great option for those who want to promote social benefits like global access to clean water, good governance, and green energy. There are many ways to invest thematically – whether it’s promoting companies run by women, or small businesses, or the arts – while generating a modest return.

Learn to deal with competing goals

In the “holistic wealth” framework, investing is not just about the stock market. It’s also about investing in your body, your mental health, your time off, your relationships, your spirituality and other parts of yourself that you think are important.

Of course, this means you’ll encounter trade-offs: Do I take a lower-paying job if it means more time with my child? Do I work long hours now if it means having a more exciting career?

Finding the support of other women who are also seeking financial wellness is key to making choices like these in which there’s no “right” answer. But having a better sense of your dream life, your values, and the hard numbers in your budget can help you feel good about these decisions when you make them.

This article is for general guidance and informational purposes only and should not be treated as legal, accounting, financial, investment or tax advice. For specific questions related to your financial, legal or tax situation, please consult a professional advisor.

Editor

Angelina YaoCredit

Photo: Arthur Elgort/Conde Nast via Getty Images